Y’s Tips Channel

このチャンネルは、日本に住む外国人のために日本の暮らしに必要な情報を英語で提供します。

#20 Gensen Choushuuhyou (源泉徴収票について)

Today I’d like to talk about Gensen choushuuhyou. I think some of you already know what Gensen Choushuuhyou looks like. However not so many people understand what Gensen Choushuuhyou means. So I’d like to tell you the detail about Gensen Choushuuhyou .

今回は源泉徴収票についてお話します。恐らく多くの方は源泉徴収票がどんなものなのか見たことがあるかと思いますが、どのような意味があるのかまでを知っている方は多くはないでしょう。詳しくお話します。

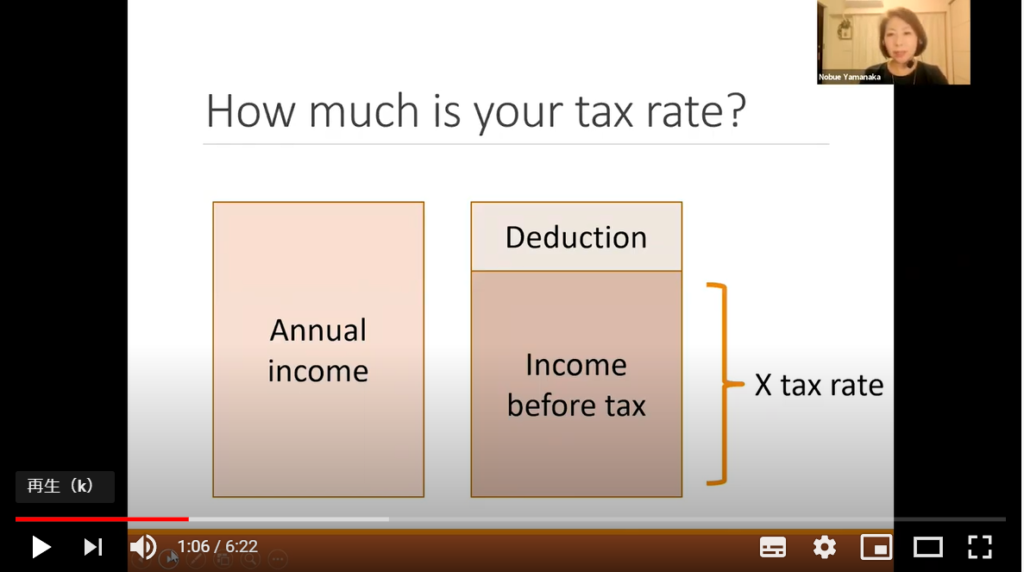

First of all we need to understand the procedure how to calculate your income tax. Here is your annual income. Some of money are deducted from your annual income as expenses and the rest of the money is called income before tax. And tax rate is applied on that.

まず最初に所得税がどう計算されるのかを理解する必要があります。こちらは年収で、年収から控除を差し引いた残りを課税所得と言います。税率はその課税所得に掛けられます。

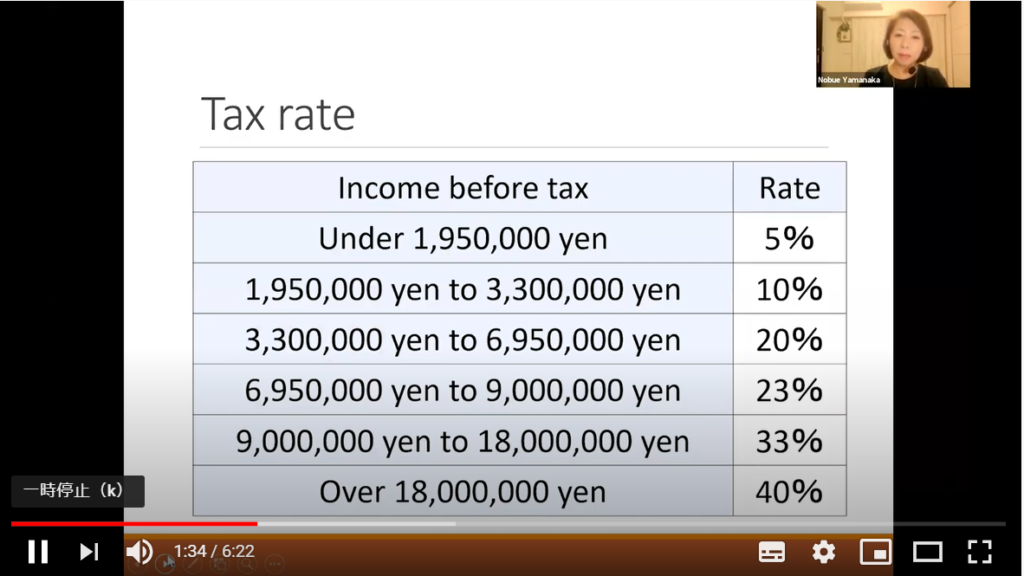

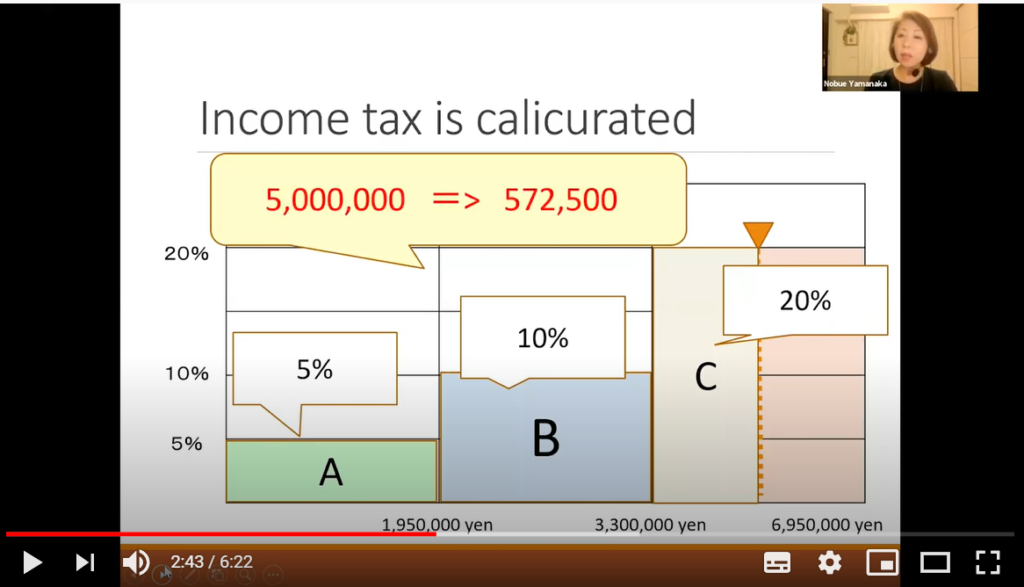

Tax rate is different according to your income before tax. Tax rate increases as income before tax gets higher. If your income before tax is 5 million, the rate is 20 percent.

税率は、課税所得により異なります。課税所得が上がると、税率も上がります(超過累進課税制度)。もしあなたの課税所得が500万円であれば税率は20%です。

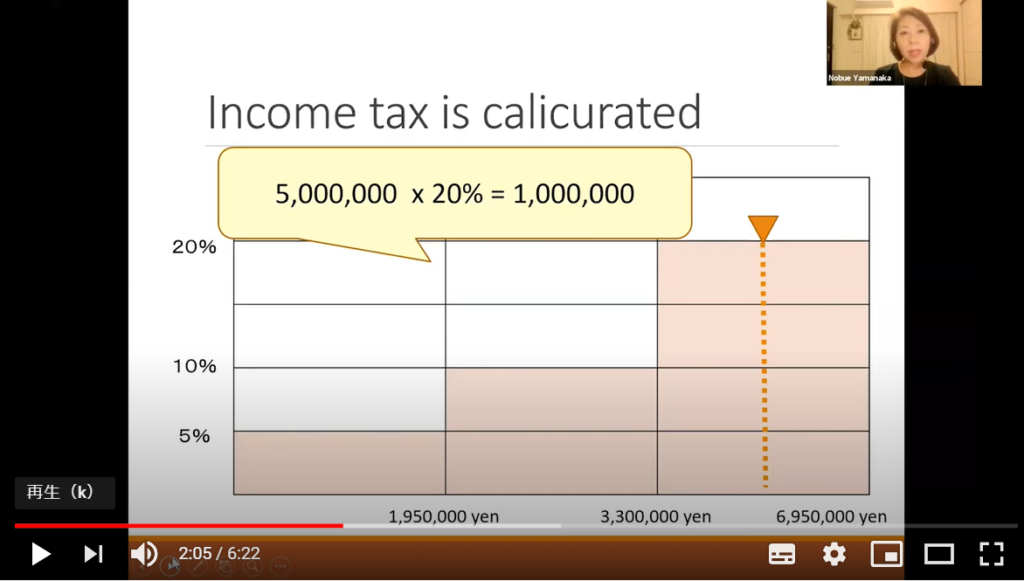

Since I said the tax rate is 20%, you may think income tax is 1 million yen for income before tax 5 million yen. However this is not correct. Because income tax rate increases just like steps so your income tax is calculated partially.

先ほど私が税率は20%だとお伝えしたので500万円の課税所得にたいする税金は100万円だと思うかもしれませんがこれは正しくありません。なぜならば、所得税率は階段のように上がっていくため、部分的に計算されるのです。

First of all you will calculate area A and five percent is apply on area A. Then second, area B is calculated and 10 percent is applied on area B. And area C is calculated and 20 percent is applied on only area C. The numbers are totaled and you can get your income tax is 572,500 yen. So this is the procedure how to calculate your income tax.

まず最初にエリアAについて5%を掛けて計算します。次にアリアBについて10%を掛けて計算します。最後にエリアCについてのみ20%が掛けられます。そしてそれぞれを合計しますから税金は572,500円となります。これが所得税の計算方法です。

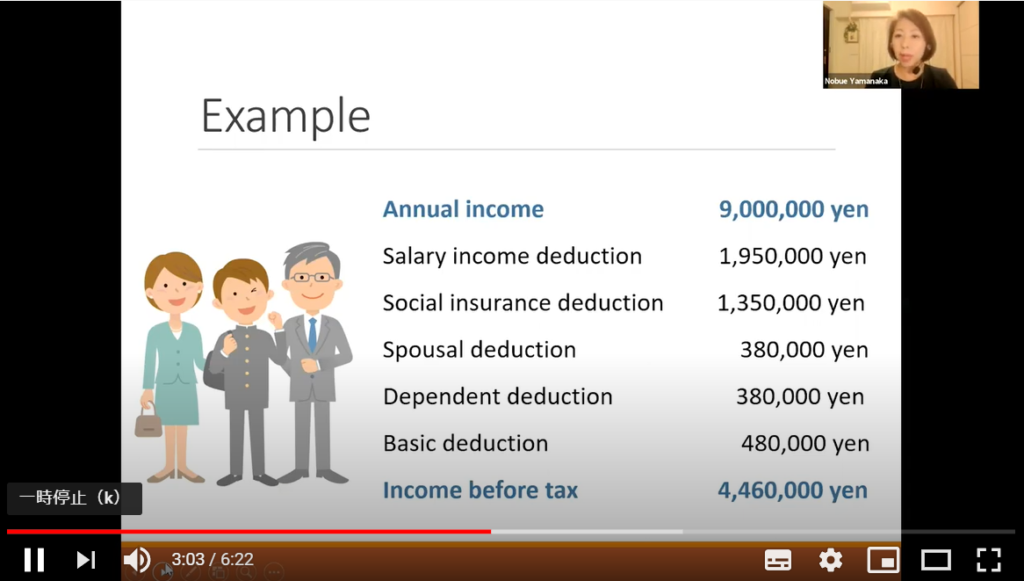

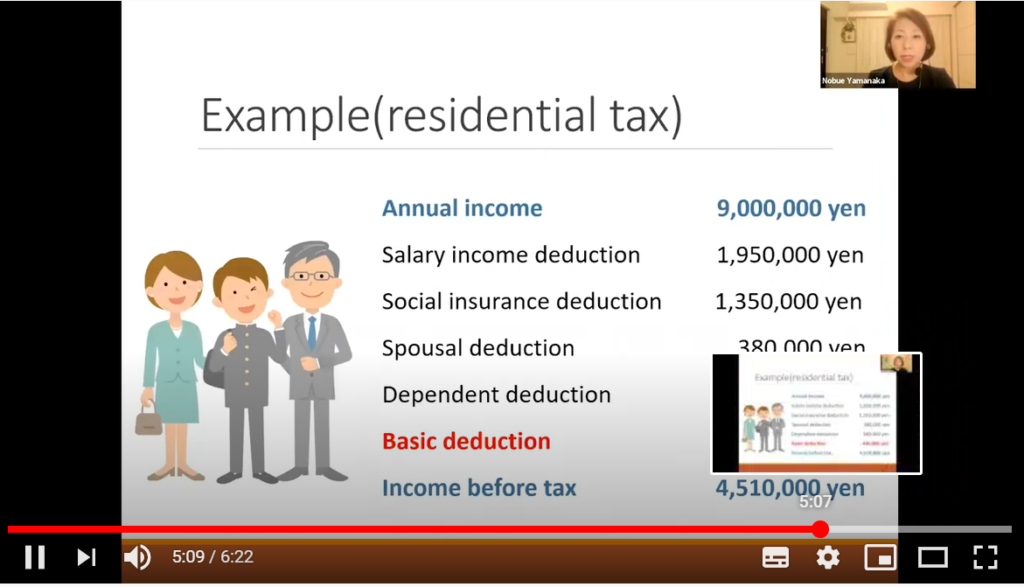

Let me give you an example. The man is working for the company and his annual income is 9 million yen. Since he is an employee he can use salary income deduction, social insurance deduction, like this. Also his wife is a dependent spouse and his son is a high school student. So he can deduct spousal deduction and dependent deduction as well. The basic deduction is admitted as an expense for all tax payers. The total deduction is four million five hundred forty thousand which is deducted from his annual income and his income before tax is 4 million 4 hundred sixty thousand yen.

例を上げましょう。この男性は会社員で年収900万円です。給与所得控除、社会保険料控除がこのように差し引かれます。また扶養の妻、扶養の息子の控除も受けられます。また基礎控除とは納税者ひとりひとりに認められた経費です。トータルすると控除額が454万円、したがって課税所得は446万円となります。

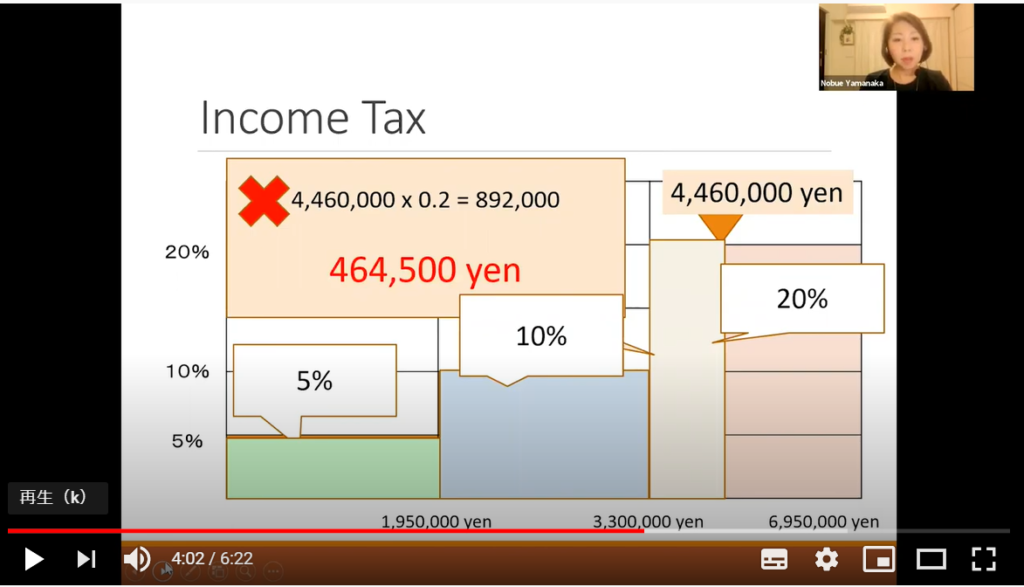

As I said income tax is calculated partially like this and this and this. His income tax is four hundred sixty four thousand five hundred yen.

先ほどお話したように、所得税は部分的に計算されます。従って彼の所得税は46万4,500円となります。

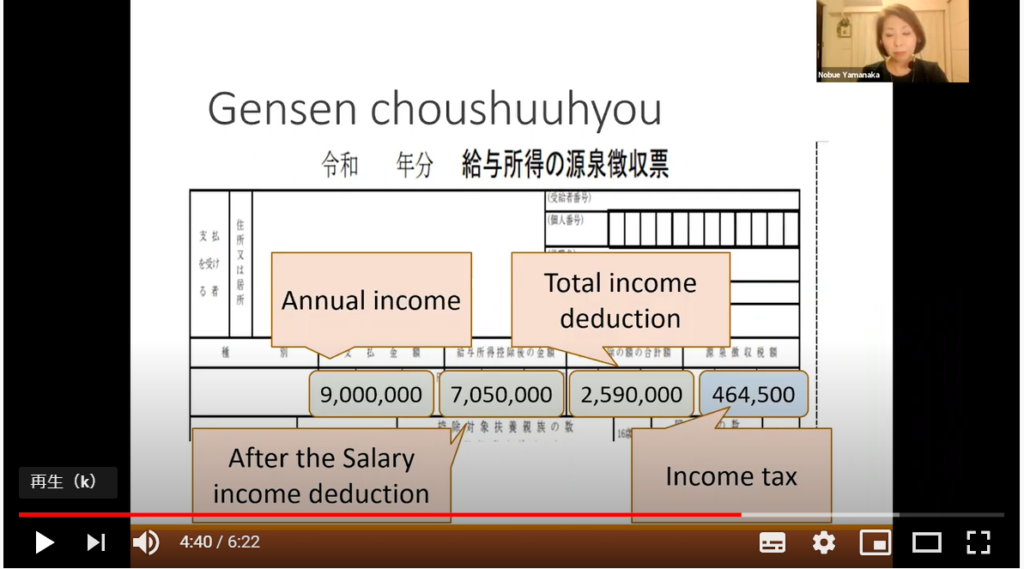

With Genshen Choushuuhyou you can see his income tax here, the blue one. And other numbers are shown like this. This is annual income, this is after the salary income deduction and total income deduction is here. However there is no income before tax on Gensen Choushuuhyou.

源泉徴収票には、所得税がこのように記載されます。青い部分です。他にも給与所得控除後の金額、所得控除の合計額が記載されています。しかし、課税所得はどこにも記載されていません。

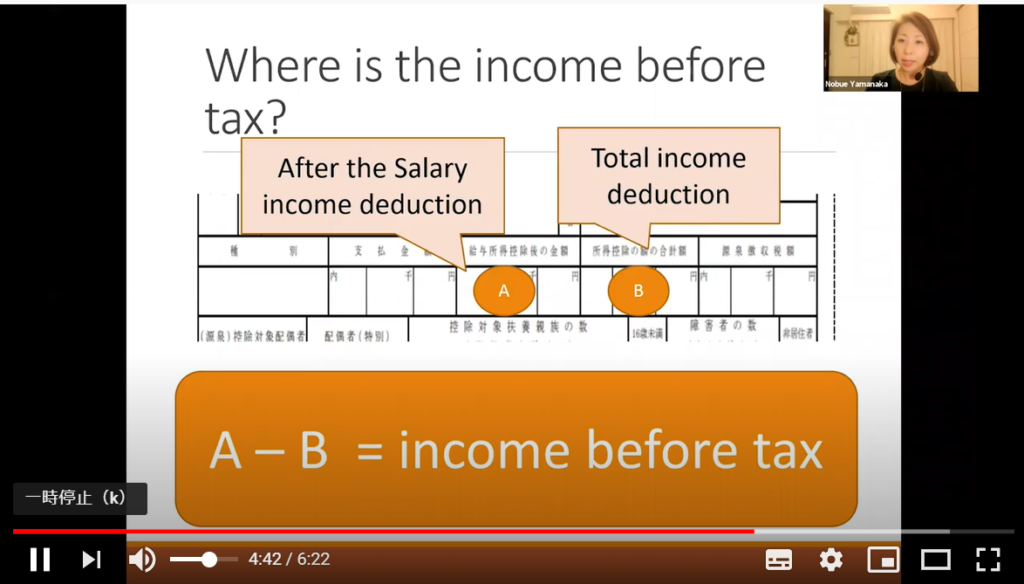

In order to get number of income before tax you have to calculate by yourself. You need two numbers A and B. A is after the salary deduction. B is a total income deduction. A minus B equal to income before tax. So Gensen Choushuuhyou is very important document to learn how to calculate your income tax.

課税所得を算出するには自分で計算することが必要です。まず2つの数字、給与所得控除後の金額と所得控除の合計額が記載されているAとBの数字を使います。A-Bが課税所得です。このように源泉徴収票から、あなたの所得税がどのように計算されるのかを学ぶことができるため、この書類はとても重要です。

Let’s move on to the residential tax. Residential tax is calculated almost the same as income tax. However the basic deduction is smaller than income tax.

では、住民税に移りましょう。住民税は所得税と同じように計算されますが、基礎控除は所得税より小さくなります。

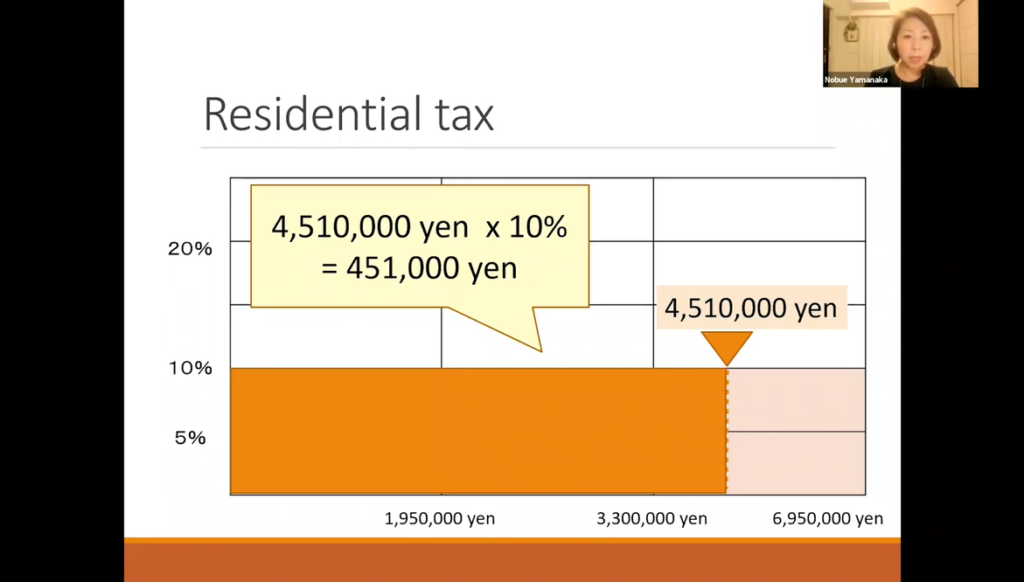

The residential tax rate is 10% for all incomes, so in this case his residential tax is 451 000 yen. This number is not deducted from the December salary.

住民税の税率はすべての所得に対して10%です。従って彼の住民税は45・1万円です。この税金は12月の給与から差し引かれるわけではありません。

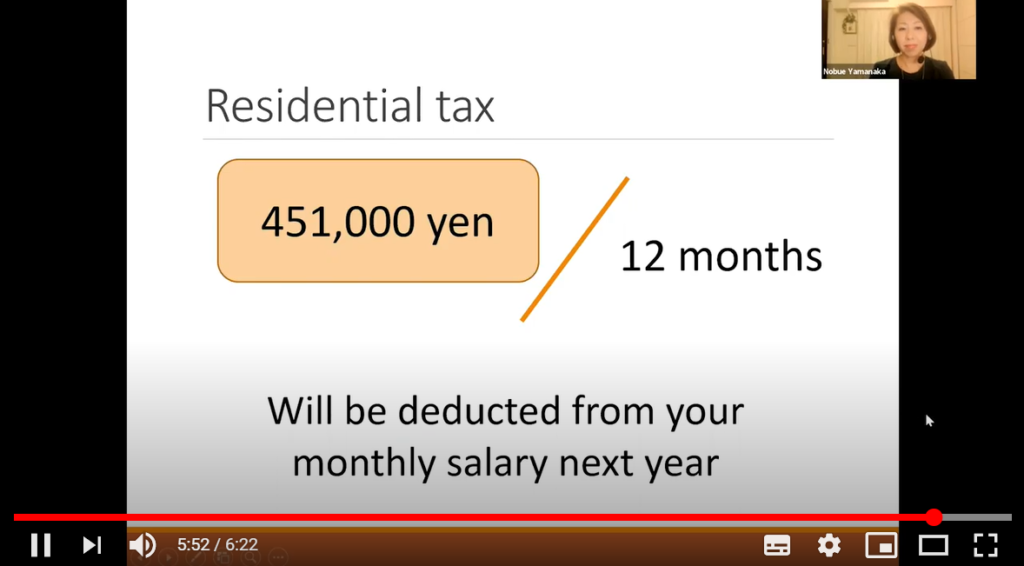

This number is divided into 12 months instead. Then it will be deducted from your monthly salary next year. That’s all for today.

住民税は12ヶ月に分割され、翌年の給与から天引きされます。これがあなたの税金の仕組みです。