Y’s Tips Channel

このチャンネルは、日本に住む外国人のために日本の暮らしに必要な情報を英語で提供します。

#28 INDIVIDUAL-TYPE DEFINED CONTRIBUTION(個人型確定拠出年金)

Today I’d like to talk about individual type defined contribution which is called ideco in japan. With ideco you can develop your asset with tax benefit.

今回は、個人型確定拠出年金 iDeCoについてお話します。iDeCoを使うと、税制優遇を用い資産形成ができます。

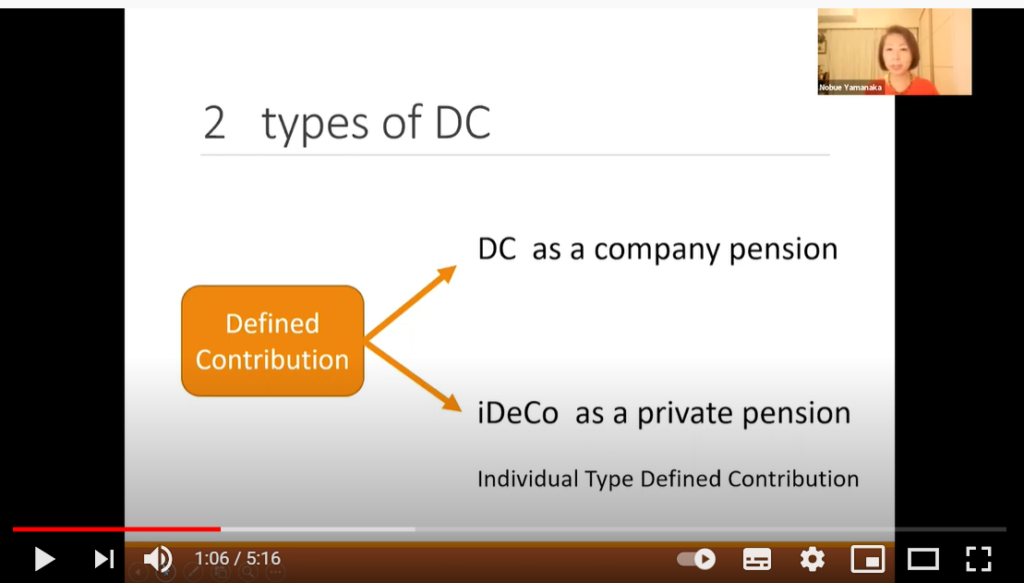

In japan, there are two types of defined contribution. Let me call it dc instead. First one is dc as a company pension, which I already talked about it with my previous video. Second one is ideco as a private pension. Ideco is an abbreviation for individual type defined contribution.

日本には、ふたつの確定拠出年金(以下DC)があります。一つ目が企業型確定拠出年金、こちらは以前の動画でご説明しました。二つ目が個人型確定拠出年金、iDeCoです。

Unlike company pension, with ideco you have to put your private money into your ideco account and you can save your money for your future. During the saving you can enjoy some tax benefit. That is ideco.

企業型確定拠出年金と異なり、iDeCoは自分のプライベートなお金をiDeCo口座に預け入れ、将来に向け運用します。その際いくつかの税制優遇が受けられる、これがiDeCoの仕組みです。

For example, he can put 20 000 yen every month into his identical account. Since ideco contribution can be added as tax deduction.

例えば、この男性が毎月2万円ずつiDeCoの口座に拠出したとします。するとiDeCoの拠出は全額所得控除となります。

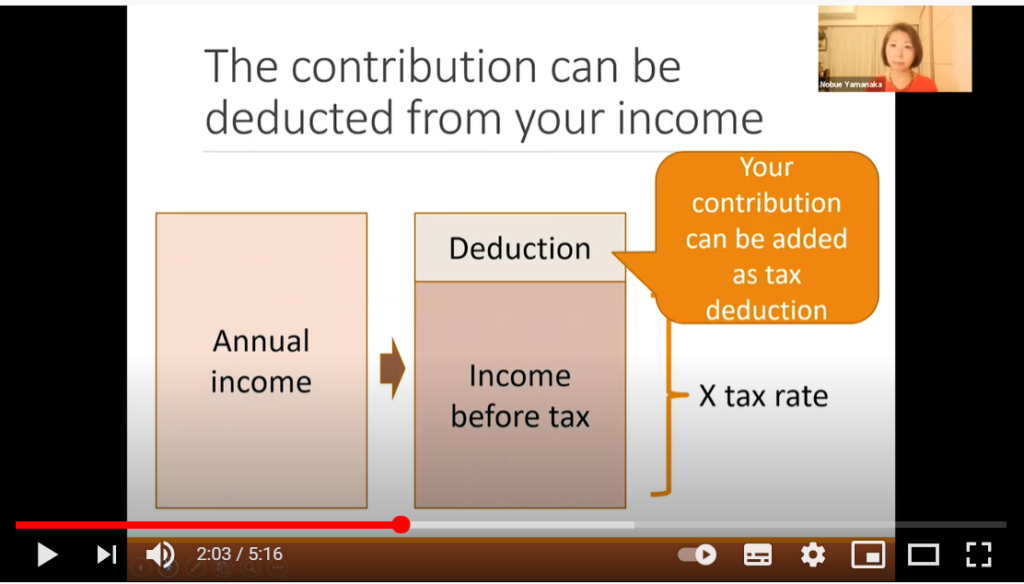

As you know, rate is charged to income before tax, not on your income. So if you can increase your tax deduction that means you can reduce your income tax.

ご存知の通り、所得税率は年収にかかるのではなく課税所得にかかります。従って所得控除が増えるということは、所得税を減らすということになります。

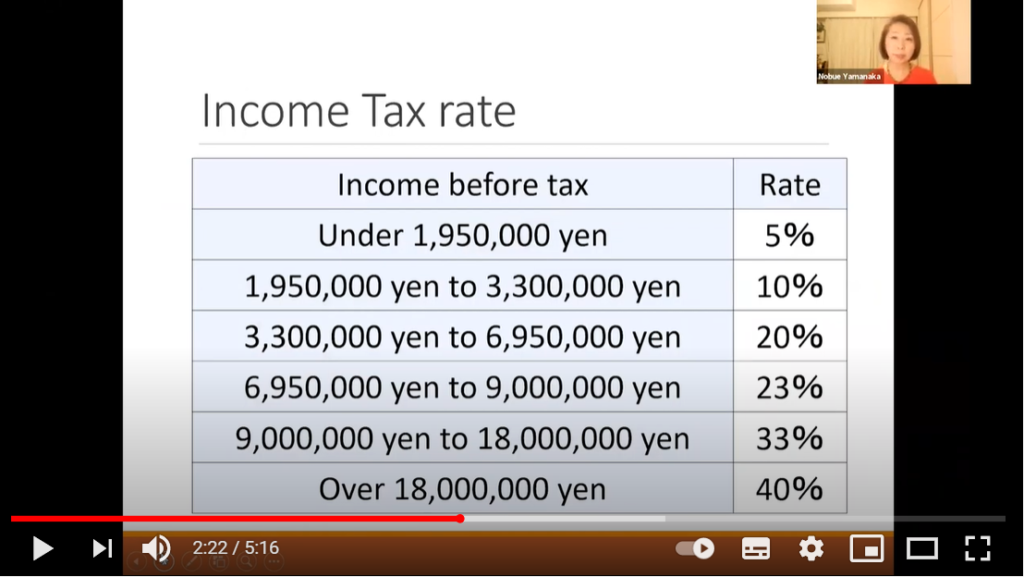

So in order to understand how much you can save your money, you have to know how much your tax rate is. Here is the income tax rate table. For example, his income before tax is 5 million yen that means his maximum tax rate is 20 percent.

iDeCoにいくら拠出するといくら節税ができるのかを知るためには、自分の所得税率がいくらなのかを知る必要があります。こちらは所得税率表です。例えば先ほどの男性の課税所得が500万円だとすると、彼の最高所得税率は20%となります。

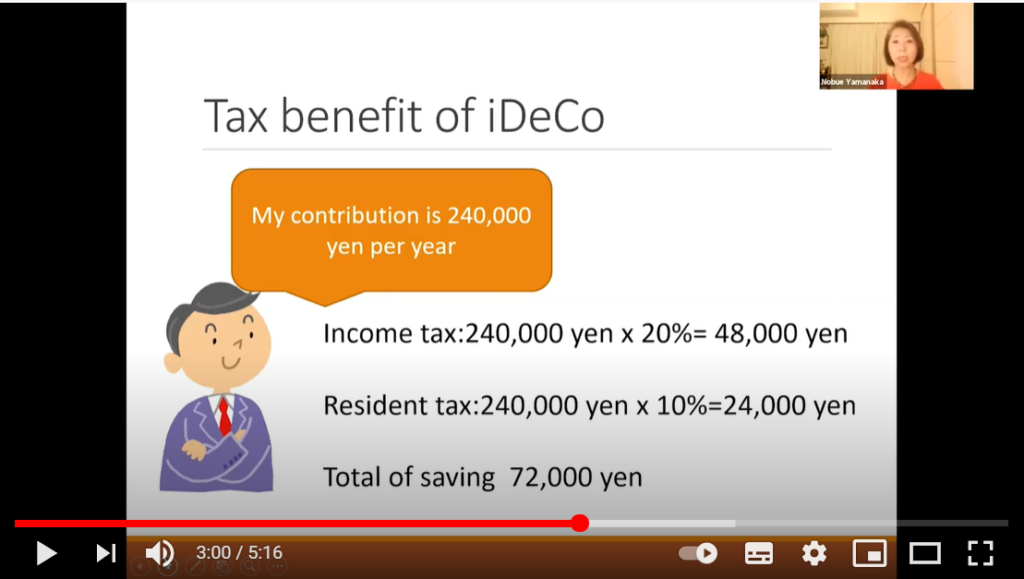

As I said, his contribution is tax deductible if he make a contribution 240,000 yen that means he can reduce his income tax by 48000 yen. Also he can reduce his residence tax by 24000 yen. As a result its total of saving is 72 000 yen. This is the first tax benefit for ideco.

申し上げた通り、iDeCoの掛金は全額所得控除となります。従ってもし彼が年間24万円拠出をすると所得税が48,000円減ります。更に住民税は24,000円減額されます。結果として、72,000円もの節税が可能です。これがiDeCoの一つめの税メリットです。

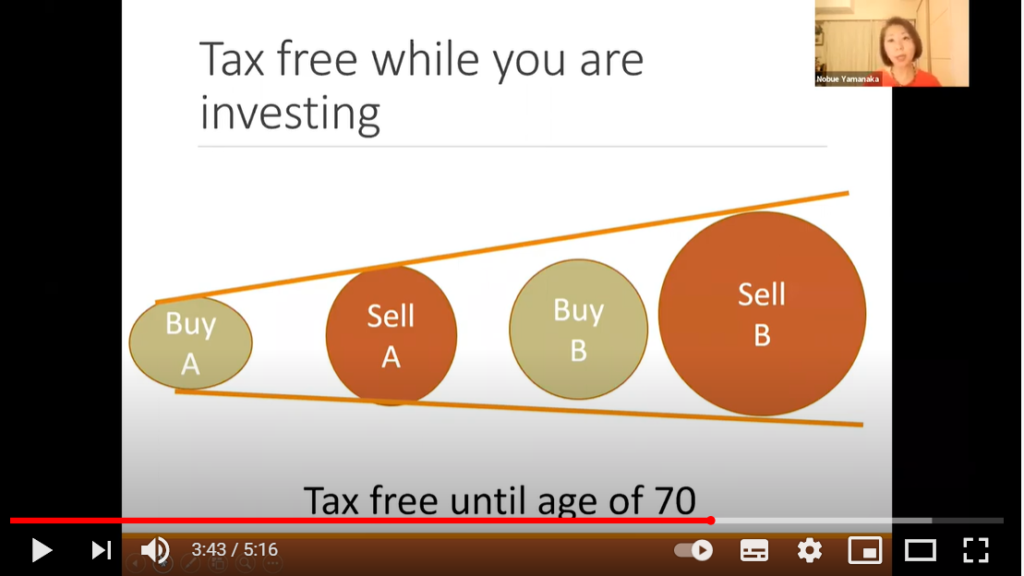

Once he puts his money into ideco account he can purchase some financial products. While investing he can enjoy tax benefit, too. This is the second tax benefit of ideco.

掛金が拠出されると、彼は金融商品を買い付け運用することができますがその際も税金のメリットを受けることができます。

Just like NISA account with ideco you don’t have to pay any income tax for the profit. For example if you make a profit without a ideco account, you have to pay 20 percent of income tax. However with ideco account you don’t have to pay income tax for the profit. You can continue the investment until age of 60 or can be extended until age of 70. So you can enjoy the tax free for a long time.

NISAと同様iDeCoの口座で運用をすると通常20%かかる税金が全くかからなくなります。iDeCoでは60歳あるいは最長70歳まで運用が継続できますから、長期間税制優遇を受けることができます。

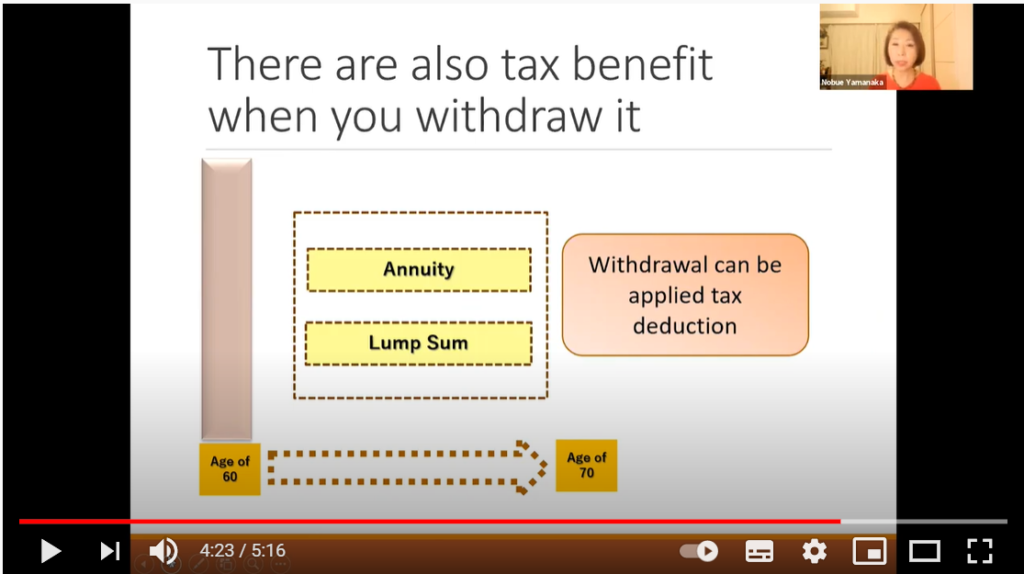

When you become age of 60 or age of 70, you can withdraw your money as a annuity or lump sum. At that time you can also use tax deduction. So this is the third tax benefit for ideco. I think you understand there are several tax benefits for ideco that’s why you can develop your money very efficiently.

60歳になると、あるいは70歳までの間で資金を一時金あるいは年金として受け取ることができます。またその際にも税金の優遇が受けられます。これが3つ目の税制優遇です。このようにiDeCoにはいくつかの税制優遇があり、これが資産形成を有効に行う理由です。